Sheetloom Use Cases

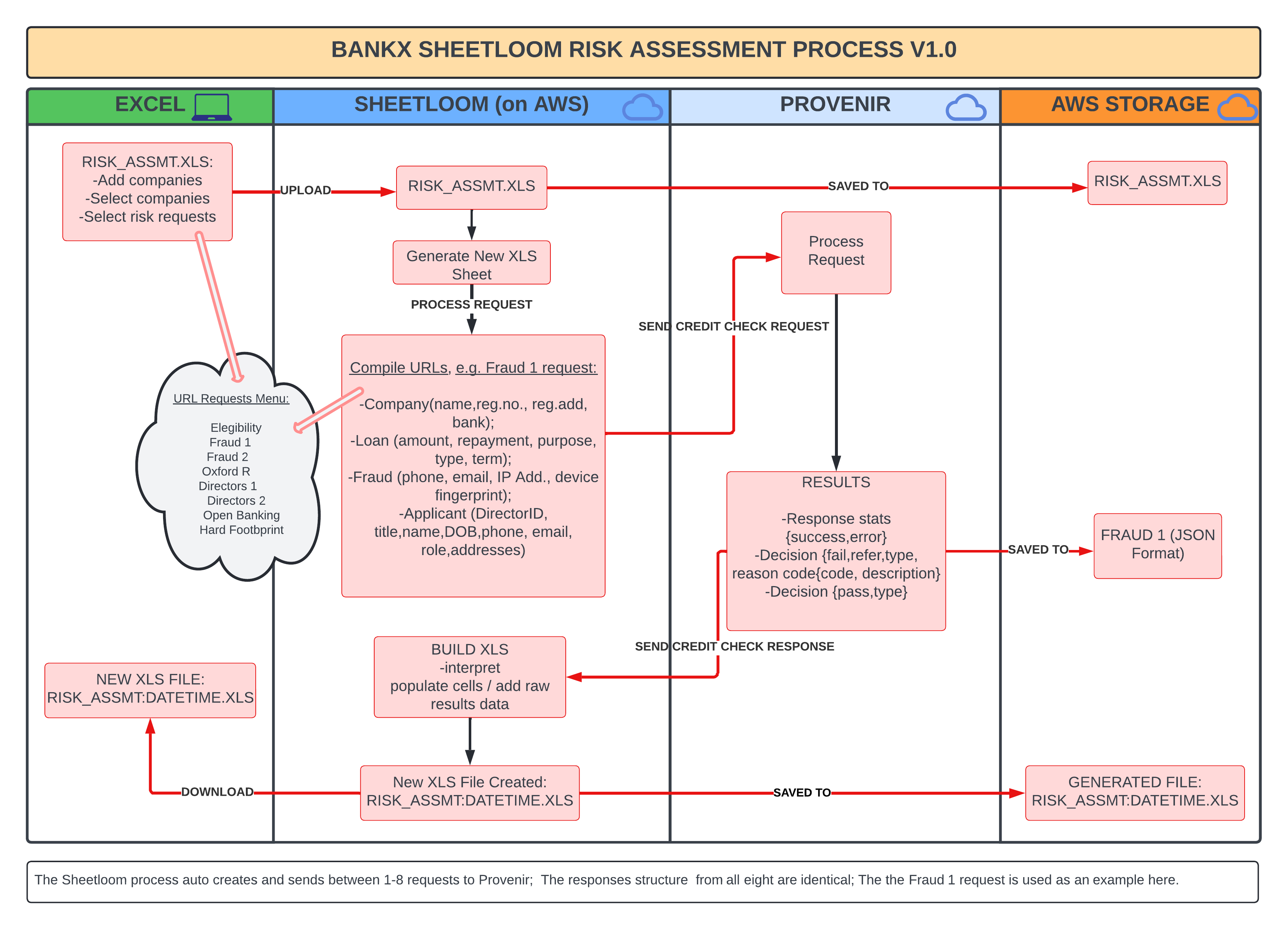

Finance - Credit Check Automation

A finance company used a mix of the latest digital tech and a human touch to bring a different approach to small businesses lending.

A crucial part of the loan review process required the company to credit score each applicant. Testing of the credit score process proved very time consuming using traditional methods. The finance company would manually; select applicants, collect individual responses and then consolidate results from a credit checking service.

The Sheetloom service was quickly installed and maintained directly on the customers environment using AWS CloudFormation. The company CFO was then able credit check each applicant automatically by simply uploading an excel spreadsheet with their details. Sheetloom orchestrated multiple API calls to the credit service, returning all responses to the spreadsheet decision model.

Using Sheetloom to check credit scores resulted in a significant cost and time saving for the finance company across multiple applicants. This saving amounted to 72 hours of the CFO's time each month.

Accounting - Cross Border and Company Reporting

Accountants regularly face the drudgery and risk of manually consolidating business transactions from different companies spread out over various reporting jurisdictions.

Sheetloom can pull the transactions from multiple companies into one consistent pivot table. These transactions can be pulled from standard accountancy packages like Xero™ and Netsuite™. The extraction can be automated and injected into your spreadsheet/decision model. Making your client reports; timely, consistent and accurate. Sheetloom can even handle all the currency inconsistencies automatically.

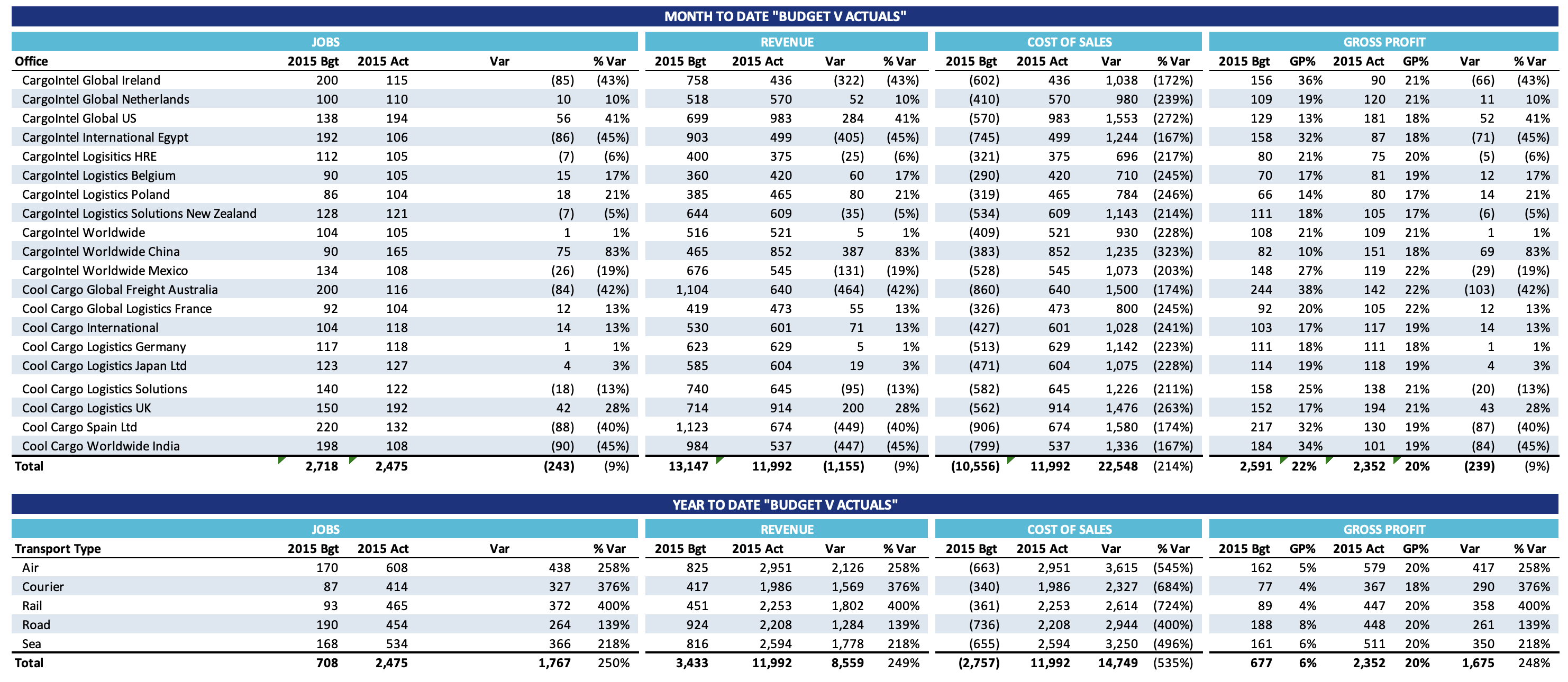

Freight Management - Operational Analysis

For freight management operations, reporting on how long shipments are taking between milestones is an important metric both for clients and operational teams. However, gathering, collating, and presenting the data can often be a tedious, time consuming, inconsistent and error prone process.

Sheetloom can automate freight analysis and inject the results into excel decision models. Results are quick, consistent and error free every time. Sheetloom can easily scale these decision models out across the entire freight enterprise, at minimal cost. With Sheetloom, everyone in the company is empowered to make decisions.

Accounting - Credit Control

Credit Control is a challenging and time-consuming affair which, if managed incorrectly, can lead to cash flow problems and even business failure. Keeping track of customer payment history, to indicate potential problems, is an important task but often; labour intensive, complex and error prone.

Sheetloom gets customer data directly into Excel from the company finance system, showing the latest payment status. Because point in time history is saved, changes in customer payment behaviour can be surfaced automatically. With real time analysis against historical trends available, staff time is freed to focus on credit management.